Turn your first rental into a lifetime check

Go from "I don't know where to start" to "I just closed my first rental" in just 30 days.

Does this sound like you?

You have saved money to buy your first property, but you're unsure where to start and terrified of blowing your savings on the wrong deal.

When you do spot a property, you're unsure how to evaluate if it's truly a good deal or a money pit in disguise.

You've been burned (or know someone who has) by bad agents, shady deals, or nightmare tenants.

Real estate documents, contracts, and the whole closing process feel like a different language (confusing, intimidating, and full of things you might miss).

You don't know where or how to even find good deals, the ones investors always seem to snap up before you see them.

You've looked for rentals but everything's overpriced, needs massive repairs, or won't cash flow for years.

You've read so much online advice, you feel more overwhelmed than when you started.

You want a property that fits your hands-off lifestyle, not another full-time job.

Most newbie real estate investors struggle into making rentals profitable for them because…

They use FHA loans the wrong way

They read online that you can buy a rental with an FHA loan. Months later, they realize the restrictions mean they can't rent it out as planned, now their "investment" is just an expensive place to live.

They fill vacancies fast with bad tenants

To cover the mortgage, they rush to place someone who "seemed nice" during a 15-minute showing. Weeks later, late payments start, complaints pile up, and they're staring down an eviction before year one is up.

They trust spreadsheet ROI over property reality

On paper, the numbers looked perfect. In reality? A roof leak, an HOA fee hike, and three months of vacancy erased all that "projected cash flow."

They choose the wrong loan

The lender got the deal done, but with an interest rate and terms that chew up every bit of profit.

They blindly trust the "experts"

They hand the reins to a realtor, lender, escrow officer, or property manager… only to find the property's in a tough rental area, the PM never returns calls, and there's $9K in surprise repairs.

They buy in the wrong location

The price was right, until they discovered the rent barely covers the bills and reliable tenants are hard to find.

Join thousands of successful rental property investors who started with zero experience

What Rentals look like when done RIGHT…

A property you're proud to own

You know the numbers, you've inspected it yourself, and there's no "I hope this works" pit in your stomach.

A deal that works in real life

You've factored in taxes, vacancies, maintenance, and you're still walking away with cash flow every month.

Confidence in your decisions

You ask the right questions, spot red flags, and negotiate like you've done this before.

Tenants who pay on time and respect the place

Your screening process filters out the headaches before they ever sign the lease.

Financing that supports your goals

You understand the terms, control your monthly numbers, and never get blindsided by the bank.

An investment that grows with you

The location's right, the price was smart, and now you've got steady rent plus appreciation, building your long-term wealth.

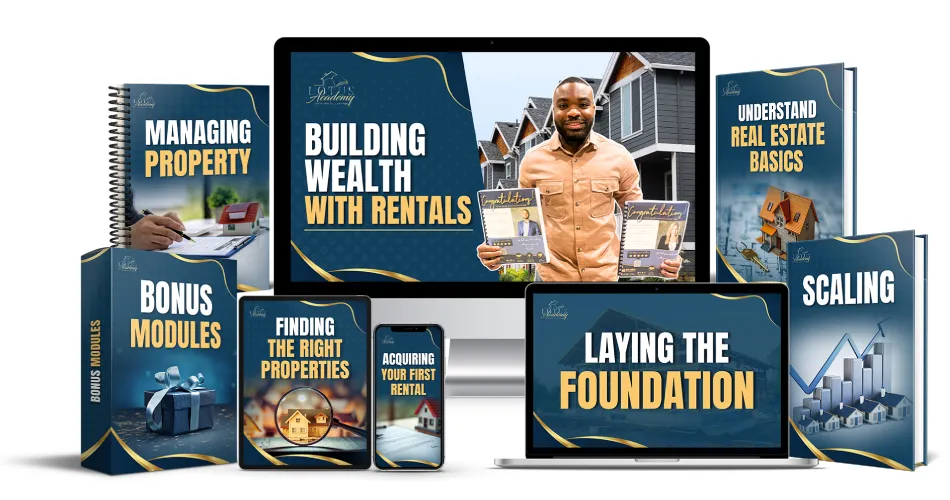

Introducing: Building Wealth with Rentals

Your 30-day blueprint to confidently buying (and profiting from) your first rental property

In just one month, you'll go from "I'm not sure where to start" to knowing exactly how to find, analyze, and close a rental deal you're proud to own, without getting burned by rookie mistakes.

Here's what you'll get inside the course:

Negotiate deals with confidence

Avoid overpaying or getting stuck with bad terms by using proven negotiation strategies.

Avoid bad deals before they drain your wallet

You'll learn exactly how to do proper due diligence, running the numbers, reviewing contracts, checking inspection reports, and spotting hidden repair costs, so you never get blindsided.

Turn your rental into a steady income stream

Find and screen quality tenants, create bulletproof leases, and keep your property cash flowing even if you want it to be hands-off.

Work with agents and pros (without being led astray)

Know exactly what to ask, what to watch for, and how to get them working in your best interest.

Understand every document and deadline

Get a step-by-step breakdown of the entire buying process, from the first offer to the day you get the keys, so you know exactly what's happening (and why)

Use your first property as a launchpad

Follow a clear roadmap to scale from one rental to many, building a portfolio that supports your life goals.

By the end of the 30 days, you won't just "know about" rentals, you'll have a clear, repeatable process to go from curious to confident, with a property that pays you month after month.

You get a 30-day blueprint that covers all you need to know about not just making your first purchase but scaling after that.

Here’s the 30-day course work:

Day 1: Welcome

See how rental properties create steady income (even while you sleep) and get a clear roadmap of the next 30 days.

Day 2: Jargon Download

Learn the must-know real estate terms so you can talk deals without feeling lost or intimidated.

Day 3: Benefits of Owning Real Estate

Understand how rentals build wealth through cash flow, appreciation, tax perks, and leverage.

Day 4: The Real Estate Sale Process

Walk through the full buying process step-by-step so you know exactly what happens from offer to closing.

Day 5: Real Estate Investment Strategies

Explore different investing styles (rentals, flips, BRRRR, wholesaling) and find the one that fits your goals.

Day 6: The Wealth-Building Mindset

Adopt the mindset that turns one property into many and helps you think like a wealth builder.

Day 7: Know Your Numbers

Review your finances, set realistic goals, and learn the numbers you must check before making any offer.

Day 8: Building Your Real Estate Team

Build your dream team of agents, lenders, and other pros and know how to choose the right ones.

Day 9: Understand Markets & Property Types

Learn how to spot the best markets and property types for steady rent and long-term appreciation.

Day 10: What Makes a Good Rental Property?

Know exactly what makes a rental profitable so you don’t end up with a money pit.

Day 11: On-Market vs. Off-Market Deals

Find out where the best deals hide, whether listed publicly or through private channels.

Day 12: How to Underwrite a Rental Property

Analyze properties with confidence so you can separate the winners from the overpriced headaches.

Day 13: Key Financial Indicators

Master the key money metrics (like cap rate and cash-on-cash return) so you can compare deals quickly.

Day 14: How to Analyze Rental Comps

Learn how to check and set rental rates so your property rents fast and for the right price.

Day 15: How Much Money Do You Need to Start?

Find out what it really costs to buy your first rental and how to start even with limited cash.

Day 16: Buying with LLC vs. Personal Name

Understand the pros and cons of buying under your personal name vs. an LLC so you protect your assets.

Day 17: How to Conduct Property Inspections

Conduct property inspections like a pro so you can catch costly problems before buying.

Day 18: Understanding the Preliminary HUD

Break down the closing paperwork so you know exactly where every dollar is going (and where to save).

Day 19: Where to Find Great Tenants

Discover the best ways to attract high-quality tenants who pay on time and take care of your property.

Day 20: How to Screen Tenants

Learn how to screen tenants so you avoid late payments, damage, and eviction drama.

Day 21: Crafting a Rock-Solid Lease

Create a rock-solid lease that protects your investment and sets clear expectations.

Day 22: Should You Hire a Property Manager?

Decide whether to manage your property yourself or hire a manager and avoid rookie mistakes either way.

Day 23: What to Know About Evictions

Learn how to handle evictions legally and quickly while protecting your bottom line.

Day 24: Creative Financing Strategies

Unlock creative financing options so you can grow your portfolio without massive upfront cash.

Day 25: The “Refi Till You Die” Strategy

Use the “Refi Till You Die” strategy to turn equity into more rentals and more income.

Day 26: Alternative Rental Strategies

Explore alternative rental strategies to boost cash flow and adapt to different markets.

Day 27: Behind the Deal – Real Case Study

See a full case study of my first rental, including numbers, challenges, and lessons learned.

Day 28: The Ultimate Rental Property Checklist

Master the key money metrics (like cap rate and cash-on-cash return) so you can compare deals quickly.

Day 29: Creating SOPs for Your Rental Business

Create systems and processes so your rental business runs smoothly (even without you).

Day 30: Investor Hacks & Hidden Savings

Steal proven investor hacks to lower costs, reduce taxes, and squeeze more profit from every property.

You’re also getting…

Access to a private community for shared learning, support, and accountability.

Lifetime access to all current and future resources, so you’re always up to date.

My private network of lenders so you can get the right financing.

And that’s not all… as a bonus, you’ll get:

Here’s the 30-day course work:

A personal case study breakdown of my very first rental deal, the wins, mistakes, and lessons that saved me thousands.

Deal Analysis Tool for evaluating properties fast.

Step-by-step guide on reducing your property tax bill legally.

Ultimate Entity Structure Blueprint to protect your assets.

Property Management SOPs to run rentals stress-free.

Hear from people who were once where you are now…

Instead of wondering if rentals really work, you’ll be looking at deposits hitting your account every month…

Here's why I can help you get it right…

When I first started working in my corporate job, I had one big goal and that is to buy my first rental property.

I immediately began saving aggressively, putting every extra dollar toward a 20% down payment.

When I finally reached my goal, I felt the pressure of the market. Deals seemed to be slipping away, and the temptation to buy something, anything, was real. But instead of rushing in, I relied on a framework I had developed to evaluate properties. That framework kept me from letting FOMO push me into a bad deal.

And then, I found my diamond in the rough.

I put $33,000 down and purchased my first rental using a conventional loan. But here's the key, I didn't just buy any property… I used a secret off-market strategy (which I'll reveal inside the course) to buy it at a discount.

That property began renting at $1,800 per month, leaving me with over $500 in monthly cash flow right from the start. Even better, my tenants stayed year after year, because I had bought right, managed well, and screened properly.

FAQs

Do I need prior real estate experience to take this course?

This course is designed for beginners, everything is broken down into simple steps, from the foundational mindset to confidently analyzing and closing your first rental deal.

Will this work if I want to invest out-of-state?

Yes! The strategies taught are location-neutral. You’ll learn how to build a reliable local team and analyze markets remotely, just like experienced out-of-state investors do.

How much money do I need to start?

We’ll break down the real costs of buying your first rental down payment, closing fees, reserves and show you how to get started even with limited capital. It’s about making smart choices, not perfect timing.

How quickly before I see results?

This course sets a 30-day roadmap that takes you from beginner to confident buyer with practical homework designed to lead straight to your first offer.

What if I have limited time?

No problem. Each lesson is short, clear, and easy to implement. You’ll also learn how to set up your rental so it runs with minimal effort, leaving you more time for your family, work, or next deal.

Contact Us

414 Milam street, Houston Texas 77002.